2021-10-18

Dispensing Doctors: Should Physicians Sell Drugs to Patients?

Sometime around 2007 or 2008, Samantha Jefferies came to her brother Trent with a request: Could he help figure out an easier way for doctors to sell prescription drugs to their patients? Typically, when doctors want their patients to take a drug, they write a prescription, and a pharmacist — generally at a local, unaffiliated pharmacy elsewhere in a patient’s community — dispenses the medication. But in the 1980s, a rising number of physicians in the United States began bypassing pharmacies and selling certain drugs directly to their patients. The practice, often called physician dispensing, is largely prohibited in many high-income countries, including Australia and Germany, but it’s currently legal in 45 U.S. states, and the practice appears to be growing.

Samantha Jefferies works in health care management in southern California. After reading an article about how this kind of in-office dispensing can generate new revenue for medical practices, she reached out to her brother for his thoughts.

Trent Jefferies had served in the U.S. Army Corps of Engineers, worked as an engineer for Black & Decker, and managed materials and logistics for a company that builds carbon fiber parts for airplanes. On the venture capital platform F6S, he describes himself as a “mech engineer, six-sigma black belt, lean expert, and supply chain guru.” After hearing from his sister, Jefferies looped in a couple other engineers and began sketching out plans. Their idea was straightforward: to build a pharmaceutical vending machine that would sit directly inside a doctor’s office or clinic.

In 2011, the group received a first round of investor funding and incorporated a company, VendRx. The next year, they filed the first of four patents on a device “for dispensing beneficial products.” To build it, Jefferies and his collaborators hired a firm that takes standard snack vending systems — “just normal candy machines, for lack of a better word,” Jefferies said — and soups them up for other applications. When the relationship with the firm soured, Jefferies says he took the not-yet-completed prototype and enlisted a new engineer, building the rest of the machine in the team’s own warehouse.

The VendRx system dispensed its first bottle of medicine to a patient at the offices of Ross Legacy Medical Group in Mission Viejo, California in 2017. (Samantha Jefferies, executive director of that group, is now on VendRx’s board.)

From the outside, the machine is a tall cabinet of off-white powder-coated steel, fitted with a large touchscreen. Inside, the system stocks up to 500 packages of medication, each nestled in a v-shaped notch. When a doctor prescribes a drug, VendRx software routes a record of the prescription to the machine. On the way out the door, the patient can stop and tap their name and date of birth onto the touchscreen. This sends a mechanical arm whirring to the correct slot, where it grasps a pre-packaged, pre-counted bottle of medicine and shuttles it to a small printer for labeling. The machine then ferries the drug to a delivery slot.

The whole process takes around 70 seconds — and the VendRx machine accepts credit cards. Even a small medical practice, the company says, can make five-figure profits through the machine each year.

Advocates for in-office dispensing argue that it is both more convenient and cheaper for patients, and some say it can also bring in extra revenue to doctors. The arrangement, supporters argue, can also bypass the elaborate and opaque vagaries of retail drug pricing that often leave patients paying far more for drugs at the pharmacy than is necessary. And given that a significant percentage of patients, even with a prescription from a doctor in hand, never end up going to a pharmacy and getting it filled, supporters also say the convenience of getting drugs directly from doctors can help close a crucial compliance gap and improve overall patient health.

Not everybody buys these arguments — least of all pharmacists. They and other critics argue that pharmacists play an important role in patient education, and that they act as a crucial safety check on doctors’ orders, helping to head off potentially dangerous drug interactions or other complications. Critics of physician dispensing also say that the arrangement involves an inherent conflict: Doctors who prescribe drugs ought not be in a position to profit off of them.

These critics can cite numerous instances, some of them garnering headlines, where physicians have abused in-office dispensing privileges by selling patients dangerous or wildly overpriced drugs in schemes that have yielded all manner of bad outcomes, from contributing to the opioid crisis to skimming hundreds of millions of dollars off the worker’s compensation system. And while supporters of in-office dispensing may argue that these outcomes have been driven by a minority of bad actors in an otherwise virtuous system that benefits patients, a small body of research from Europe and East Asia suggests that, given a profit motive, many doctors will prescribe drugs differently than their non-dispensing colleagues.

“Physicians are human beings, and when you look around, people react on their financial incentives. They do,” said Christian Schmid, a Swiss economist who studies physician dispensing. “I don’t think that physicians have a switch where you can switch off these incentives.”

Those concerns appear to have done little to dampen enthusiasm for the practice in the U.S., where VendRx is part of a percolating economy of software vendors, drug repackagers, and other market players seeking to get more doctors in the driver’s seat when it comes to dispensing medication. In June 2020, the editorial board of The Wall Street Journal weighed in on the issue, describing physician dispensing as an “easier and cheaper” option for getting drugs, and calling the pharmacy “a needless middleman.” Sarah Callioras, the director of sales at Datascan, which sells software to dispensing physicians, says that interest among doctors is “definitely, definitely growing.” Some industry sources say that the Covid-19 pandemic, which has put financial strain on many independent medical practices, has also generated new interest. In the past several years, dispensing has also become popular among physicians in the direct primary care movement — a fast-growing clinical model that aims to offer low-cost care without involving insurance companies. This arrangement, some supporters say, has provided particular benefit to low-income communities lacking insurance, because their direct-care doctors can sell them their drugs at or near wholesale prices.

Recently, some advocates of physician dispensing have sought to press their case in court. In 2019, the Institute for Justice, a public interest law firm that backs libertarian causes, sued the state of Texas over its physician dispensing ban. (The law currently allows for some exceptions, including for doctors in certain rural areas.) A similar action in Montana, launched in June 2020, ended this year after the state legislature and governor passed a law legalizing the practice. The Texas complaint alleges that dispensing restrictions stifle competition in the pharmaceuticals market and infringe on doctors’ rights.

Still, the idea of physicians selling drugs at all — let alone doing so via vending machine — troubles some experts, who argue that, whatever the purported benefits, doctors profiting from their own prescriptions creates a situation that’s ripe for abuse. Doctors are experts at diagnosis, said Scott Knoer, the chief executive of the American Pharmacists Association, or APhA, but drug dispensing, he said, is different.

“It’s shocking,” Knoer added, “that anyone would want to take pharmacists out of the medication use process.”

Physician dispensing advocates sometimes argue that they are hearkening back to an older way of doing medicine, when doctors would keep a medicine cabinet in the back and patients could leave the clinic with a tonic in hand. But the history is slightly more complicated — and rife with competition. “The big story here is the turf battles between pharmacists and physicians,” said David Courtwright, a drug historian at the University of North Florida. “There’s always been this rivalry between physicians and pharmacists.”

Before 1900, American physicians commonly sold drugs directly to their patients. But they also relied on local pharmacists to actually mix or compound some of the drugs they prescribed. Starting in 1902, though, federal lawmakers began to tighten control of the drug market. The Pure Food and Drugs Act, passed in 1906, set regulations for labeling medications. It also established the regulatory agency that would evolve into the U.S. Food and Drug Administration. In 1938, legislators moved again, adding new labeling requirements, and mandating that new drugs receive approval before going on the market. They also introduced a requirement that certain dangerous medicines only be given to patients with a prescription from a medical provider.

In the years that followed, some patients continued to buy certain drugs from their doctors, and some pharmacists continued to compound medications. But, as regulation increased, the diverse pharmaceutical market began to consolidate. With that transition, said Lucas Richert, a historian of pharmacy at the University of Wisconsin-Madison, pharmacists began “moving away from this role of compounders, and moving into a role where they are offering pharmaceutical services in their own shops.”

In 1951, Congress passed the Durham-Humphrey Amendment, clarifying the definition of what’s considered a prescription drug. By the middle of the decade, the now-familiar model had crystallized: A small number of pharmaceutical companies had come to dominate drug manufacturing, churning out nearly all medicines in centralized facilities, with oversight from the FDA. To access those drugs, patients would typically take that prescription to a pharmacy — as they still often do today — and buy the medication from a licensed pharmacist.

In the years since that choreography was routinized, prescription drug expenditures have ballooned in the United States — to nearly $370 billion in 2019. By the 1980s, some entrepreneurs had begun offering physicians the opportunity to get a cut of the growing market. These firms purchased drugs in bulk, then repackaged them into smaller quantities and sold them to physicians’ offices, which in turn — depending on state regulations — could mark up the drugs and sell them to patients for a profit.

The fast-growing industry alarmed some policymakers. In 1987, Ron Wyden, at the time a young Democratic congressman from Oregon — he’s now a U.S. Senator — sponsored legislation to limit physician dispensing. The repackagers, Wyden told The New York Times that year, are “a bunch of fast-buck artists,” trying to bring doctors into a scheme to make “easy money.” In a congressional hearing, Wyden brought samples of the sales pitches that repackaging companies sent to doctors. “Every time you sign a prescription,” he quoted from one, “it’s like writing a check to the pharmacy.” Another ad he quoted promised to show physicians “how to earn $52,000 this year with no investments.”

According to The Times, lobbyists descended on the Capitol. Nancy Dickey, chairperson of the American Medical Association’s Council on Ethical and Judicial affairs, testified that while the organization felt “physicians should avoid regular dispensing and retail sale of drugs,” it opposed Wyden’s bill because it represented an “inappropriate intrusion” into state affairs. Meanwhile, pharmacy organizations supported Wyden. So did Arnold Relman, an M.D. and the longtime editor of The New England Journal of Medicine. “Trust in one’s physician is an essential but fragile ingredient of good medical care,” he wrote in an editorial. “It may not withstand the conversion of physicians into vendors of drugs for profit.”

The drug repackagers won. Wyden’s bill died.

Today, just five states — Massachusetts, New Hampshire, New Jersey, New York, and Texas — maintain broad physician dispensing bans. (In a sixth, Utah, legislators recently relaxed a dispensing prohibition, but the practice remains off-limits for most clinics.) Even in those states where the practice is largely prohibited, exceptions are common. In Texas, for example, dispensing is permitted in rural clinics far from the nearest pharmacy. New York makes an exception for drugs “pursuant to an oncological or AIDS protocol.” And in states where dispensing is banned, physicians may still be able to give out free drug samples, or dispense enough medicine to last a patient for 72 hours.

In the rest of the country, dispensing is fully legal. Some states do require physicians to apply for a simple license before dispensing, but most do not. Today, some companies specialize in repackaging drugs for physician dispensers. And large national drug distributors that mostly supply pharmacies, including McKesson and AndaMEDS, also supply drugs to physicians.

Getting a handle on the current size of the industry is difficult, particularly given that no single source tracks the number of doctors who do their own drug sales. One indication comes from MDScripts, a company that builds software for dispensing physicians, and that one industry source described as holding a dominant share of the market. MDScripts says that it serves more than 50,000 providers at more than 17,000 sites across the country. Last fall, the company president, Gary Mounce, suggested MDScripts had more than half the total market share – although, he noted, there are no reliable estimates of the total size of the market.

While traditional insurance plans will reimburse for physician-dispensed medications, rates can vary widely, often making it impractical for clinics. Instead, dispensing tends to thrive outside the umbrella of traditional insurance. It’s especially common at clinics that serve workers’ compensation patients — people injured on the job or who have an illness related to their work whose subsequent care is covered by a special form of insurance. Dispensing is also common in specialties, such as weight-loss medicine and dermatology, where insurance often does not cover common prescriptions if they’re not deemed medically necessary.

Reviews of advertisements and other marketing materials suggest that operations that serve dispensing physicians can come and go quickly. One person who has built a large and lasting business in the space is Brian Ward. A 6’3” offensive guard for the Louisiana State University football team back in the 1990s, Ward began working in pharmaceutical sales soon after graduating. Around 2008, AstraZeneca — the pharmaceutical industry giant where he was then employed — was offering buyouts, so Ward began looking for new business opportunities.

Ward said the answer came to him after his father got injured at work. When his father went to the doctor for a workers’ compensation visit, he was handed the medication before he even left the office. Impressed, Ward said he got the company name off the label from his dad and started searching online. Shortly after, he and his wife, Jennifer, launched a company from their home in Mobile, Alabama, selling physician dispensing services to clinics. The company, DocRx, essentially acts as middleman: They market the idea of dispensing to physicians, manage billing, and comply with regulations. They furnish physicians with software and help connect practices with existing repackagers. DocRx itself does not itself repackage drugs.

When they started the company, Ward said, most dispensing practices in the area served workers’ compensation patients. Ward saw an opportunity. “I wanted to capture that insurance and cash-pay patient, that self-insured patient, the ones that have a $30 copay, but I can offer them medication for $10,” he said.

Working a sales beat in Alabama, Mississippi, and Louisiana, Ward said, the company signed up doctors to start dispensing drugs from their offices. When a competing salesman, hoping to discredit the young company, started telling doctors that the Wards didn’t even have an office, they rented a space. (Later, they hired the competing salesman.) Over time, DocRx branched out into other services. Today, along with their dispensing business, they offer diagnostic tests to clinics, sell medical supplies, and even supply products to some pharmacies. As of last fall, Ward and Jane Glover, the company’s director of marketing and communications, said DocRx had grown to around 150 employees, working with some 1,500 physicians, concentrated in the South.

In a phone call, Ward said that he and his colleagues “don’t normally talk about the financial side with physicians.” Doctors, he said, “are doing this for the patient,” and most don’t make a large amount of money. Like others in the industry, the company cites research suggesting that as many as one-third of prescriptions are never even filled. The increased convenience of in-office dispensing, Ward and other advocates argue, boosts compliance and improves care.

Still, in an online pitch to prospective clients, the company stresses that revenue from dispensing can “be quite significant,” explaining that, because of low drug prices, “physicians can easily add a significant markup and still provide them at a lower or equal price to many patients’ co-pays.”

Ward’s company sued a rival firm that used a similar name — DocRx Dispense — for trademark infringement in 2014. Ward won, and the latter company appears to no longer exist. As recently as last fall, however, an animated video outlining the benefits of in-office dispensing — created by the now-defunct rival company — was featured on multiple pages of Ward’s DocRx. In the spot, an animated man energetically extolls the profit potential of physician dispensing, and blames the Affordable Care Act, a sweeping health care reform law passed in 2010, for hurting the revenues of private doctors’ practices.

“Yes,” says the cartoon man, wearing a yellow necktie and gesturing with upraised hands, “I can’t emphasize enough that it provides significant profit to your practice.” That profit, he explains, “can be as low as $50,000 a year. It could be as high as a million to $3 million dollars a year, depending on the size of your practice.”

Asked about the video in a phone interview, Ward sounded confused. Later, after viewing it on the website, he said his web manager may have mistakenly posted it. “That will need to be taken down asap as that is not us,” he wrote in an email.

Soon after, the video was gone.

The rise of in-office dispensing in the U.S. comes alongside significant evolution in the pharmacy profession, which has moved towards more expansive and more advanced medical training. In 2000, it became the standard for all new pharmacists to receive a doctorate in pharmacy (called a PharmD), which requires a minimum of two years of “specific, pre-professional coursework” at the undergraduate level, atop four years of professional study in the biological, chemical, and physical properties of medications, according to the American Association of Colleges of Pharmacy.

Some pharmacy schools also require a specialized admissions test, and leaders of the field have pushed for new pharmacists to do post-graduation residencies, as well.

Pharmacists must also pass the North American Pharmacist Licensure Examination, as well as a pharmacy jurisprudence exam, before being able to dispense medications.

It’s a rigorous gauntlet that advocates say allows the pharmacist to take a more active — and clinically important — role in overseeing patients’ complex drug regimens, guarding against potentially harmful drug interactions, and even providing some medical advice. “We are the medication experts on the health care team,” said Micah Cost, who at the time of an interview in August 2020 was executive director of the Tennessee Pharmacists Association. “We are the only professionals that get four years of targeted medication-related education. So we really have a unique value in the system.”

Laws that permit doctors to circumvent pharmacists, industry advocates suggest, serve physicians’ bottom lines more than patient health. “This has got to be a revenue thing,” said Knoer, the APhA chief. “There’s no way that any physician in their right mind — and you can quote me on that — that any physician in their right mind would want to take the safety check of a pharmacist out,” he continued.

“It defies logic,” Knoer said. “So this has got to be purely an economic thing, increasing revenue in physicians’ offices.”

Not every pharmacy advocate is staunchly opposed to physician dispensing, and some leaders in the field say they see a place for it. “Our position is that it’s okay on a limited basis,” said Aliyah Horton, executive director of the Maryland Pharmacists Association. “But we are not supportive of full-on physicians just being able to dispense anything and everything, and turning themselves into a practice and a pharmacy at the same time.” Her organization has pushed for more clear regulations to ensure that physicians dispense safely.

During the Covid-19 pandemic, Horton said, she has seen physicians in the state advocating for expanded dispensing. But, she said, pharmacists offer “a little bit of check and balance” — perhaps especially in times of unrest.

For example, early in the pandemic, after then-President Donald Trump began advocating for an unproven Covid-19 treatment, hydroxychloroquine, many doctors rushed to prescribe it for themselves, family, and friends. (Subsequent studies have failed to show the drug treats Covid-19.) As Undark reported in March 2020, the spike in prescriptions led to shortages of the drug for patients who needed it to manage lupus and other unrelated, chronic conditions. In some cases, pharmacies stepped in to push back against the wanton prescribing, and Horton said pharmacists also intervened with doctors who had never dealt with the drug before, and who were unknowingly trying to obtain inappropriately high doses.

Pharmacists, she noted, are sometimes “a barrier for inappropriate prescribing.”

Some dispensing advocates counter such arguments by pointing to recent reports suggesting that overworked pharmacists at chains like CVS are making more errors, potentially endangering patients themselves. A two-year long investigation by The Chicago Tribune, published in 2016, enlisted the help of drug interaction experts and a cooperating physician to send reporters to 255 pharmacies throughout Illinois — Walgreens, CVS, Costco, and other chains, as well as independent pharmacies — seeking to obtain two contraindicated, prescription-only medications. In some cases, the drug combinations arranged would be deadly if a patient were to take them together. In the end, 52 percent of the pharmacies visited filled the prescriptions without ever mentioning any possible interactions. The newspaper called it “striking evidence of an industrywide failure that places millions of consumers at risk.”

Still, such errors in the real world would begin with doctors, pharmacy experts caution, and Knoer argued that most physicians, at one time or another, have had pharmacists call and alert them to major potential errors. “It’s a team,” he said. “Pharmacists are, by far, more trained in pharmacotherapy.”

His colleague Daniel Zlott, formerly a specialist in oncology pharmacy at the U.S. National Institutes of Health and now an executive at the APhA, echoed the point, suggesting that more than 10 percent of handwritten prescriptions contain some kind of error. “One of the things that I used to do as a pharmacist,” Zlott said, “was catch those errors, left and right, and stop them from ever reaching a patient.”

In 2014, Geoffrey Joyce, a health policy scholar at the University of Southern California, sent students to 500 pharmacies around Los Angeles with prescriptions for the same set of generic drugs. The prices the pharmacies quoted for them, he recalled, varied from $10 to $200 for a single generic drug. “The uninsured consumer is really vulnerable,” Joyce said.

Indeed, while common wisdom holds that generic drugs ought to represent cost savings for American consumers, the millions of patients who buy their drugs in cash — because they are uninsured or underinsured — are particularly vulnerable to erratic pricing for generics. Meanwhile, physicians have found ways to sell generic drugs directly to patients, sometimes at far lower prices than pharmacies offer.

The lifecycle for most generic drugs begins in China and India, where a vast network of factories produce the base chemicals that feed the global pharmaceutical chain. They then sell those chemicals to other manufacturers — again, often in China and India, but also Europe and the U.S. — who use them to synthesize the actual active pharmaceutical ingredient, or API. Finally, a drug manufacturer measures and mixes that API into a tablet, capsule, or cream that’s ready for the market. For generics sold in the U.S. market, Joyce said, that third stage usually happens in the United States.

It’s at this point that the generic drug enters a series of opaque financial arrangements typically modeled with elaborate flowcharts. For many generics, the manufacturers set the average wholesale price, or AWP — but that figure is largely a placeholder. “The sticker price may or may not have any relation to the cost of that drug,” said Antonio Ciaccia, president of 3 Axis Advisors, a consulting firm, and the CEO of 46brooklyn, a nonprofit research shop that studies drug pricing data. (Analysts joke that AWP stands for “ain’t what’s paid.”)

Instead, the price that consumers encounter at the pharmacy has a lot to do with a middleman called a pharmacy benefit manager, or PBM. In theory, the PBM exists to help health insurance providers bargain for lower prices. But in practice, according to a growing chorus of experts, advocates, and policymakers, a handful of PBMs now dominate the pharmaceuticals market, raking in enormous profits while driving up prices. In that byzantine system, said Ciaccia, “everybody in the supply chain,” including pharmacies and PBMs, can sometimes be incentivized to seek out higher priced products from suppliers, knowing that will allow them to capture larger payments down the line.

By the time a drug arrives at the pharmacy, various players in the chain have taken a large share.

A 2017 report from scholars at the University of Southern California Schaeffer Center for Health Policy and Economics found that for every $100 spent on generic drugs, only $18 actually goes toward the manufacturing costs.

Consider cyclobenzaprine. First synthesized by a pair of chemists — one a Merck employee and the other a consultant for the company — in 1956, the drug reached pharmacies in the 1970s as a muscle relaxant and pain reliever, under the brand name Flexeril. It’s often prescribed to people with workplace injuries. In 1989, Merck’s patent on the drug ran out. Today, any FDA-registered drugmaker can apply for approval to manufacture and sell generic cyclobenzaprine. The final drug, according to federal pricing data, tends to be pretty cheap when pharmacies purchase it directly from a generic drug wholesaler — around 2.5 cents per 10 mg pill, or 75 cents for 30 tablets.

When patients pay in cash at the pharmacy, however, the average price for a 30-pill bottle, according to the pharmaceutical coupon firm GoodRx, is $18.23. With a coupon, you can pick it up at, say, Walmart, for $12.09 — cheaper, but still carrying a hefty markup.

|

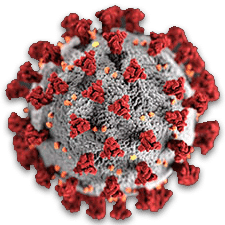

For all of Undark’s coverage of the global Covid-19 pandemic, please visit our extensive coronavirus archive. |

Pharmacies have little control over the final pricing, Ciaccia said. But dispensing physicians operate outside that system, and they have access to low wholesale prices. For example, an internal pricing sheet from a dispensing clinic in Wichita shows a large drug distributor selling cyclobenzaprine directly to the clinic for less than 2 cents per pill in August 2021. A doctor could take that bottle of medication, tack on a $10 markup, and offer it for a cash price that’s still lower than it might be at a local pharmacy — and lower than some insured people’s copays.

Chris Lupold, a family physician in Ronks, Pennsylvania, has been dispensing since 2017. He says he doesn’t mark up the drugs he dispenses to turn a profit, instead advertising low-cost, in-office pharmaceuticals as a service to prospective patients. (Lupold’s practice makes money by charging a monthly membership fee to patients.) During visits, Lupold often walks patients through drug pricing, showing them the wholesale rates for their regular prescriptions. He estimates that he can beat pharmacy prices “probably 97 percent of the time.”

Some patients find those conversations upsetting. “I’ve heard some foul language,” he said. “‘I paid a $20 copay for that bottle,” patients will say, and “you can get it for me for $2? What are you talking about?’”

Not all dispensing doctors sell their drugs at such low rates, however. Some experts, echoing concerns expressed in the 1980s, worry that physician dispensing could open the door for unscrupulous practices — and warp the decision-making of even well-meaning physicians.

“There is definitely a perverse financial incentive there,” said Matthew McCoy, a medical ethicist at the University of Pennsylvania, after reviewing the details of common physician dispensing arrangements at Undark’s request. McCoy studies conflict of interest in health care, and he points out that just because a conflict of interest is present does not mean that a physician necessarily acts on it. “But it’s just objectively true,” he said, “that if you’re one of the practices that’s driving some revenue through the sale of pharmaceuticals, then you have an incentive to prescribe more pharmaceuticals to your patients.”

Ciaccia was more blunt: “You’re essentially granting a physician a printing press for money.”

Physician dispensing advocates point out that there are other situations in which a physician’s medical decision affects their income. “What’s the difference between [dispensing] and a doctor owning an X-ray machine, and making money on the X-ray machine?” asked Trent Jefferies.

McCoy acknowledges that conflicts of interest exist in other realms. But, he argued, that’s not a reason to allow new ones into the doctor’s office. “I think it’s still incumbent upon us to try to eliminate those additional unnecessary conflicts that might be built into the way that the business of medicine is conducted in the United States,” he said.

At least one medical association has expressed similar concerns. In Australia, where dispensing was permitted only at about a dozen rural clinics as of 2018, the Australian Medical Association opposes dispensing for “material gain.” That year, the organization’s then-ethics chair warned that such sales had “the potential to undermine trust in doctors.”

In the U.S., the country’s flagship association of physicians supports allowing physicians to dispense, in accordance with its ethical guidelines. The American Medical Association’s code of medical ethics states that physicians “may dispense drugs within their office practices provided such dispensing primarily benefits the patient.” The code goes on to warn doctors to “avoid direct or indirect influence of financial interests on prescribing decisions.” But it does not directly discourage physicians from selling pharmaceuticals for profit.

Asked for comment on the American Medical Association’s position, Robert Mills, a media relations manager at the AMA, sent over a copy of those ethics guidelines. The AMA policies, he noted, support “physician dispensing in accordance with AMA ethical guidelines, free of legislative restrictions that conflict with patient access to appropriate prescribed drugs.”

There has been virtually no research in the U.S. on whether dispensing changes the behavior of physicians. But research from some European and East Asian countries suggests that McCoy’s fears do play out — and raises questions about the AMA’s position.

The great laboratory for physician dispensing research is Switzerland. The mountainous country is chopped up into 26 largely autonomous cantons; some ban physician dispensing, some partly allow it, and others don’t have any restrictions. The resulting patchwork creates a series of natural experiments, allowing economists to match up similar practices, and then to try to tease out, from years of prescribing data, whether dispensing physicians prescribe differently than their peers who don’t dispense.

Sometimes, circumstances give those researchers a perfect case-study. In 2008, after 57 years of prohibiting the practice, the cities of Zurich and Winterthur, in Switzerland’s German-speaking north, voted to legalize physician dispensing. The law went into effect in 2012, after an unsuccessful legal challenge from pharmacists. Physicians who had spent years referring their patients to pharmacies could suddenly begin selling some drugs themselves.

Schmid, the Swiss economist, and two colleagues recently began combing through prescription data from before and after the policy change. They wanted to see if the physicians started prescribing differently once they had profits on the line. The data, Schmid says, is clear: They did. “They don’t treat the patients worse. But they use the system to earn more money,” said Schmid, head of the CSS Institute for Empirical Health Economics, a research center in Lucerne that’s affiliated with a large Swiss insurance company.

The team found that, after 2012, physicians prescribed more expensive drugs. They also appeared to favor smaller packages of drugs, which, under the Swiss health care system, generate more revenue per pill. Those additional costs added up, costing an extra 30 to 40 Swiss francs — or $32 to $42 — per patient each year, according to the economists’ estimates. (The team has presented their data at conferences, and they released a working draft of the paper in July 2020; it has not yet been published in a peer reviewed journal).

That finding reflects the conclusions of peer-reviewed research Schmid did as a graduate student, as well as studies from several other economists in Switzerland. “I’m rather confident that we see physician dispensing increases health care expenditures,” said Schmid. But, he stressed, the data focuses only on costs, not health outcomes: “I do not know whether the treatment becomes better or worse.”

Researchers are now scrutinizing dispensing practices in England, too. There, dispensing is allowed for patients who live far away from pharmacies, meaning it’s most common in rural clinics. According to one study, around one in eight practices do so.

For part of her doctoral dissertation at the Düsseldorf Institute for Competition Economics, the economist Olivia Bodnar, along with three colleagues, recently studied prescribing data from nearly 8,000 practices in England. The researchers selected dispensing practices, and then tried to match them up with non-dispensing practices that were similar in almost every way — size, patient demographics, physician age, and many other variables — except that they do not dispense. Then, they compared the matched-up practices to see if their prescribing patterns differed.

As in Switzerland, the data suggests that English doctors act differently when they sell drugs. They prescribe more drugs than their non-dispensing colleagues, including more opioids and antidepressants. They also prescribe smaller packages of drugs, which allow physicians to rack up larger fees. “We find evidence that they react to financial incentives,” Bodnar said.

Comparable statistics are not available in the United States. But, as in the 1980s, advertising targeted to doctors suggests that profit is an important motive for many dispensing doctors — and that those earnings can be substantial. BRP Pharmaceuticals, a major repackager in California, claims on its website that practices “have seen profit increases of up to 50 percent — without taking on any additional patients, staff, or equipment.” First Coast Health Solutions, a supplier in Jacksonville, Florida, tells physicians that they can bring in “$12, $15, $18, or more” per prescription and “net up to $100,000 per year.” (Neither company responded to repeated requests for comment.)

“If someone told you, as a physician, you could earn an extra $75,000 to $200,000 per year without having to see any additional patients, work more hours, or increase your overhead, wouldn’t you like to know how?” asks a 2008 video for MedXSales, an Akron, Ohio company that offers “ancillary revenue products and services,” including drug dispensing, to doctors. In an interview, MedXSales’ president, Gary Silbiger, said the company stopped using the video nearly a decade ago, and no longer foregrounds profit in its pitch to practices, instead emphasizing the benefits of greater compliance and convenience for patients. “We just don’t promote, in any kind of marketing, the financial opportunity of dispensing any longer,” he said.

“We do not want to attract physicians whose number one goal is to dispense for profit,” he added.

Jefferies and VendRx, the automatic dispensing machine company, do make profit projections: A slide deck previously posted on the company’s website suggests that doctors add a $10 markup on each sale. Of that, $2 goes to VendRx as a transaction fee, and the clinic pockets the rest. The company estimates that a doctor who directs 30 percent of prescriptions to the machine will net $18,000 each year.

Jeff Coulter, the owner of PharmaLink, which provides software to several hundred dispensing practices, said interest from potential customers tends to ebb and flow. When revenues shift — from, say, a change in insurance payouts to physicians — interest in dispensing goes up: Any time insurance companies change their reimbursement policies, he said, “we typically see a lot of new interest in this.”

Robert Palm, the vice president of Calvin Scott, which repackages and sells specialty drugs to weight-loss clinics, said that some practices in the company’s network sell the drugs at cost. Some tack on a fee of $10. Others, he admitted, “mark it up an insane amount.”

There are also cases of outright abuse, especially when physicians peddle opioids. “Physician dispensing was a major part of the opioid epidemic when it first started,” said Khary Rigg, a substance use researcher at the University of South Florida. In the 2000s, in an attempt to map the phenomenon, Rigg and colleagues would stand outside shady south Florida pain clinics, interviewing users. “Many of them reported going to and seeking out physicians and pain clinic practices that dispense their own medication,” Rigg said. The dispensing clinics allowed people illicitly seeking opioids to “take the pharmacist out of the equation,” he said, hopping around to different doctors and eliminating “one more opportunity to get caught.”

In 2010, according to Drug Enforcement Administration data, the top 90 physician-dispensers of oxycodone in the United States were all in Florida. That year, the state passed new regulations on pain clinics, followed in 2011 by limits on physician dispensing of opioid painkillers. Overdose death rates dropped.

Today, Rigg said, prescriptions are no longer a major driver of opioid addictions and deaths. But in many states, some physicians continue to sell pain pills directly to patients.

Christopher Jones, the acting director of the National Center for Injury and Control at the Centers for Disease Control and Prevention, has studied the role of physician dispensing in opioid use. In general, he said, he worries that “taking the pharmacist out of that prescriber-patient-pharmacist loop has the potential to increase risk.” There are cases, he said, where physician dispensing “may make a lot of sense for a patient and provider.” But, he said, the practice “has the potential” — as demonstrated in some of Jones’ own research — “to lead to bad actors engaging in the process.”

Rigg is skeptical of dispensing. “I think most physicians are ethical, most physicians are good people,” he said. “But the truth is, when doctors start profiting off the medication they prescribe, it’s not a small financial incentive we’re talking about. We’re talking about tens of thousands of dollars in most cases, sometimes even hundreds of thousands of dollars” each year. Those kinds of incentives, he warned, shape physician behavior.

“The people who are pushing for physician dispensing are physicians,” he said. Rigg noted that some doctors say that dispensing is principally about convenience, or about improving patient access to drugs. “The truth is, it’s not really about that,” he said. “It’s about making more money.”

Perhaps the most lucrative corner of the physician dispensing industry can be found in workers’ compensation claims. Under the workers’ comp system, an injured worker goes to a doctor, who provides care and then bills the patient’s employer, or, more often, the employer’s insurer. In most states, the employer or insurer is legally obligated to pay for appropriate care, even if it’s very expensive.

“As a result, the patients are completely removed from the cost of care as a consideration, which is great, because you want the patients to get the care they need and not worry about the cost,” said Joe Paduda, a health care consultant and prolific blogger on workers’ compensation issues. But, he added, that arrangement also creates opportunities for “unscrupulous providers” to “game the system by figuring out creative ways to deliver inappropriate services, deliver too many services, and charge way too much.”

Physician dispensing, Paduda and other analysts say, has been one way those providers make money. Alex Swedlow, president of the nonprofit California Workers’ Compensation Institute, said he started noticing questionable behavior in the early 2000s. He and his colleagues found some physicians were dispensing cheap generics drugs for 10 or 11 times the price available at pharmacies.

In response, legislators in California, Illinois, and other states passed laws trying to keep physician-dispensed drugs tied to the market prices for drugs. But, in 2012, the policy analyst Vennela Thumula and her colleagues at the Workers Compensation Research Institute, a not-for-profit research firm in Massachusetts that receives some insurance-industry funding, noticed more unusual activity. Dispensing physicians in California and Illinois were selling new dosages of cyclobenzaprine and several other common, cheap generic drugs: 7.5 mg tablets of cyclobenzaprine, for example, instead of existing 5 mg and 10 mg pills. What differed were the prices: In California, physicians were dispensing a bottle of 7.5 mg cyclobenzaprine, and collecting around $3 per pill instead of the 35 to 70 cents per pill providers were charging for other dosages.

It was, analysts say, a clever workaround: States had required physicians to sell drugs to injured workers at rates pegged to manufacturers’ listed prices. So some manufacturers had come up with new dosage products — with new, inflated list prices — for physicians to dispense.

It wasn’t the only time that dispensing physicians found a loophole that allowed them to overcharge. “This is one in a series of innovations that happened when physician dispensing reforms were implemented,” said Thumula. Swedlow agreed: Over the years, he said, a small number of dispensing clinics have shown “a certain creativity” in finding new ways to work the system.

“The vast, vast, vast majority of physicians, and the vast majority of physicians I’ve spoken to, are not a part of this problem,” Swedlow said.

“The cost driving behavior is really being driven by a very small minority of providers,” he continued. “That said, it doesn’t take a whole lot of physicians to tip the system.”

The constant game of whac-a-mole has infuriated some industry analysts. “It was a brilliant strategy to completely screw employers and taxpayers,” said Paduda of the new dosage scheme. In the past, Paduda has worked as a consultant for PBMs, a role that included talking with policymakers about physician dispensing. He has also personally clashed with some people in the industry: A few years ago, a software company that serves dispensing physicians sued him for libel, based on his blog posts. (The case was thrown out.) Today, Paduda says, many insurers have simply given up on fighting against inflated physician dispensing costs, seeing them as a relatively minor drain on the U.S. workers’ compensation market, which covers more than $30 billion in medical costs each year.

Paduda does not believe the argument that physician dispensing, by allowing patients more convenient medication access, helps them get better faster. “That’s just patently false,” he said. “There’s no data, no research, no science to back that up.” And, Paduda insists, the damage of dispensing is real and lasting. One 2014 study of injured workers in Illinois found that those who received care from a dispensing physician were out of work longer and received more drugs. And the financial costs do add up: Paduda estimates that dispensing practices, by selling drugs at inflated rates, siphon “probably well north of $200 million” out of the U.S. worker’s compensation system each year.

“That’s the money,” he said, “that these physician dispensers are stealing from employers and taxpayers.”

Those concerns have not stopped a new generation of advocates from arguing that physician dispensing can be done responsibly — and that it could be one way to help patients get more convenient, lower-cost access to drugs. Among them is Michael Garrett, a family physician in Texas. About a decade ago, Garrett moved from Indiana to Austin, Texas. In 2014, he opened a direct-primary care, or DPC, practice in the western suburbs of Austin.

At DPC practices, patients pay a flat fee for easy access to a physician, along with wholesale prices on lab tests and other medical services — including, in states that allow physician dispensing, drugs. Hundreds of DPC practices have popped up around the country in the past decade. The model is popular among doctors who are frustrated with insurance companies. A disproportionate number of DPC doctors seem to cite Ayn Rand as an influence.

According to DPC doctors, their patients gravitate to the model for all sorts of reasons. Some don’t have health insurance. Others are insured but want more access to a physician than they would get in a typical practice. Garrett’s practice charges adult patients between $60 and $110 per month, depending on their age. Since he opened the practice, his roster of patients has grown to 550 people.

In most states, one service DPC doctors offer is access to wholesale medications, dispensed directly to patients, typically with little or no markup. As a physician in Texas, Garrett can’t do the same. The regulation upset Garrett, who, like Lupold in Pennsylvania, said he often sits down with patients to help them review their medication costs. Using online wholesaler catalogs, he said, “I can pull up the medicines right there, and I can see, oh, wow, I can get a thousand of these pills for $8, and my patient is going to go pay $8 at Walgreens for 30 pills.’”

Several years ago, Garrett joined a few colleagues, many of them fellow DPC doctors, who were lobbying the Texas state legislature to repeal the dispensing ban. The pro-dispensing push did win supporters, including Rep. Tom Oliverson, a Republican from Cypress, a Houston suburb.

Oliverson, a practicing anesthesiologist, has received widespread praise for piloting bipartisan legislation that aims to reduce prescription drug prices. (Texas Monthly, a left-leaning outlet, named him to its list of the best legislators of 2019 based on that work.) A group of pro-dispensing doctors, he recalled, showed him data comparing the costs of diabetes medication at CVS to the rates available via in-office dispensing. “It was like 80 percent savings. It was astounding,” he said. “The markup of some of these drugs is just insanity compared to what the wholesale acquisition cost is.” In 2019, Oliverson and two colleagues — one a Democrat — sponsored a bill to legalize dispensing in Texas, while prohibiting doctors from dispensing controlled substances, such as opioids. The pushback was “pretty intense,” he said. “It turns out, in Texas, being a big state, there are independent pharmacists … in pretty much every House district. And this an issue that they very much dislike.” The bill, along with companion with the same aim, died in committee. (So did another bill introduced this year.)

As the legislation floundered, the Institute for Justice, the libertarian legal organization, approached Garrett about joining a lawsuit. He agreed. “I would hope that it would not have go the route of litigation,” Garrett said. But “we failed through other means.” Dispensing, he said, would allow him to best serve the needs of his patients. “I really believe that this is what’s right,” he said. “I think it’s going to make the world a better place.”

The Institute for Justice has pursued anti-regulatory cases in many states, and it has received funding from the Koch family, the DeVos family, and other major conservative donors. The Texas law, said Joshua Windham, the organization’s lead attorney on the case, “isn’t really designed to protect patients. It’s designed to protect pharmacies from competition.” In Montana, where Windham and his colleagues recently filed a similar case, all three plaintiffs ran DPC practices.

The Texas Medical Association and the Texas Academy of Family Physicians have backed efforts to allow physician dispensing. The Texas Pharmacy Association did not respond to requests for comment, but chief executive officer Debbie Garza told D Magazine in 2019 that the organization “is opposed to physician dispensing and believes the practice puts patients’ health and safety at risk.”

So far, the lawsuit has been unsuccessful: The Travis County District Court in Texas upheld the state’s dispensing ban in December 2020. In a press release, the Institute for Justice said it will appeal the decision. (IJ dismissed the Montana case in May, when Gov. Greg Gianforte signed legislation ending the state’s dispensing ban.)

Oliverson said that he finds the argument that doctors can’t safely dispense drugs to be “dubious at best.” And he stressed that cost is major issue for him: “In this era of high prices for prescription drugs, I think we need all options on the table.”

One argument for Oliverson’s approach is 1,200 miles to the north, in Grand Rapids, Michigan, where Belen Amat opened a small DPC practice in 2017. Amat is from Mexico, and her patients are mostly Spanish speakers, working in the factories and farms of western Michigan. Around 70 to 80 percent of them, she estimates, are uninsured. Some are undocumented.

Amat only stocks cheap generic drugs, and she sells them to her patients at cost. When patients need medications that she does not keep in her small inventory, she said, she’ll make a wholesale order just for them. If the patient can’t come and pick it up, she just drops it in the mail at the post office near her clinic.

“When people are counting the dollars, it’s a big difference if you can save some money on your medications,” said Amat. “And it helps with compliance, too. Now that’s not a question — can I take the medication? You can afford it, you can take it.” Since she started dispensing, she said, she’s gotten a better read on who was taking their medication, and who’s been skipping it. “That’s been an eye-opener for me,” she said, adding that she’s more aware “because I’m the one giving them the pills.”

Lupold, the dispensing doctor in Pennsylvania, also runs a DPC practice. Like Amat, he said that dispensing has helped him learn more about when his patients do — or do not — take their medicines. Lupold is friendly with the pharmacist down the street in their small town, and he knows that his choice to dispense has likely hurt the man’s business. “But it is what it is,” Lupold says. “I’ve got to do what I think is best for the patient.”

Asked about the possibility of physician error during a conversation last fall, Lupold paused. “Let me talk and tread carefully,” he said, noting that some pharmacists had been “spectacular” in helping him deal with complex patients.

“Unfortunately, the majority of pharmacists, what it seems from my perspective, is most of them are button pushers,” he continued. They are racing to deal with a high volume of prescriptions. Occasionally, he said, pharmacists will call him to double check a detail. But catching a serious prescription error? “I cannot tell you the last time,” Lupold said, “and I’ve been out of medical school 19 years now.”

Wherever one lands on the questions of physician dispensing, virtually everyone agrees that the lines between pharmacists and doctors are changing — and some of the territorial encroachment is working in the opposite direction, with many retail pharmacies starting to look and act a lot more like doctor’s offices. In 2006, CVS partnered with Minute Clinic to open walk-in clinics, staffed by physician assistants and nurse practitioners, in many of the drugstore’s locations. The clinics offer basic health screenings, vaccinations, and other services. Other major national chain pharmacies launched similar programs. Those clinics received a boost in August 2020, when the U.S. Department of Health and Human Services began permitting pharmacies to administer routine childhood immunizations. The decision, said then-HHS Secretary Alex Azar in a statement, would offer “easier access to lifesaving vaccines for our children.”

Physicians have resisted many of those changes, which they see as an incursion on their own area of practice. But, for some physician-dispensing proponents, the fact of pharmacies opening clinics should give clinics leeway to act a bit more like pharmacies. “What’s good for the goose is good for the gander,” said Texas state Rep. Garnet Coleman, a Houston Democrat, explaining why he co-sponsored a physician dispensing bill with Oliverson. “The traditional lines,” he added, “are going away.”

Brick-and-mortar pharmacies face stiff competition from new models for getting drugs to patients. Mail-order pharmacy services in particular have long alarmed their traditional counterparts. Many experienced a surge in new orders at the beginning of the Covid-19 pandemic. In November 2020, the online retail giant Amazon opened a mail-order pharmacy, promising discounts and free two-day delivery to Amazon Prime members. Stock prices for CVS and other pharmacy chains plunged.

For Trent Jefferies and VendRx, the upheaval in pharmacy has not yet translated into much business. Only 10 of the fully automated vending systems are operating. Recently, the company launched a leaner product, resembling an airport check-in kiosk, that processes medication sales but does not actually dispense the drugs.

Still, Jefferies imagines a future in which, for the sake of cost and convenience, most patients get drugs in the mail, via delivery, or from their doctor’s office. In that world, he argues, brick-and-mortar pharmacies will mostly have disappeared. The ones that remain will help physicians manage new or unusual medications, and they will act as hubs, servicing a network of automated dispensing stations.

Jefferies compares the VendRx to Redbox — the ubiquitous automated DVD-rental kiosks that squat outside grocery stores and gas stations across the U.S. Why, he asked, did Redbox help kill the brick-and-mortar rental company Blockbuster? Because people want convenience. And while Redbox has faced new competition from streaming services like Netflix, Jefferies has more confidence in the future of pharmacy alternatives: “You can’t stream medication.”

UPDATE: This piece has been updated to clarify that, in addition to insurance industry funding, the Workers Compensation Research Institute also receives funding from other sources.

This article was originally published 10.11.2021 on Undark. Read the original article.